The majority of business in America are structured as pass-through entities as pass-through business entities can be anything from a sole proprietorship to an S corporation. As such, these businesses need to understand how the Tax Cuts and Jobs Acts will affect their tax preparation.

Pass-Through Business Entities And Qualified Business Income

The most important change for pass-through entities is the 20% qualified business income (QBI) deduction that business can use while filing their upcoming taxes. However, that 20% QBI deduction is not guaranteed.

Pass-through business can receive 20% QBI deduction if it is lower than the taxpayer’s business or trade. They potentially receive a different deduction, such as:

- 50% of the total W-2 wages which the pass-through entity paid to employees.

- 25% of the total W-2 wages and add 2.5% of the original purchase cost of the business’ actual property.

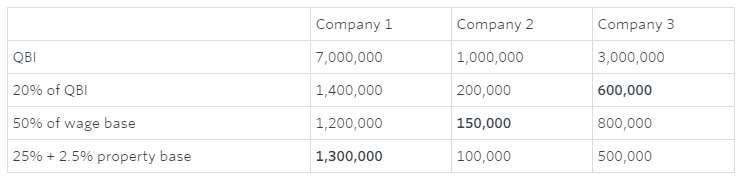

This deduction method can be difficult to visualize. To help you visualize how these deductions may affect your business, below our accountant has provided an example.

The bolded amounts are the appropriate deduction for each of the example companies.

Limitations For The New Tax Code QBI Deduction

There are some limitations when it comes to what qualifies as QBI. The types of income which don’t qualify as QBI are:

- Annuity payments

- Capital losses or gains

- Payments to partners for services

- Interest and dividends

- Foreign currency losses or gains

- Business owner compensation

For those pass-through entities which operate their businesses in the service industry, there are income limitations to receiving the 20% QBI deduction.

- Consulting

- Actuarial Science

- Health

- Law

- Financial Services

- Performing Arts

- Athletics

- Brokerage Service

- Accounting

These service-oriented businesses begin to receive less of a QBI deduction when the income hits $157,500 for an individual filer and $315,000 for joint filers. There is no QBI deduction for individual filers who earn $207,000 or for joint filers who earn $415,000.

Another key limitation for pass-through entities to remember is that the deductions discussed above will only last until the end of the 2025 tax year.

It can be complicated for a small business to grasp all the tax changes and appropriately apply them to their pass-through business. To receive high-quality accounting assistance for your business, contact us to work with our accountant.

Speak Your Mind