Once tax returns have been filed, most people breathe out a sigh of relief and promptly put it out of their mind, unless they are waiting on money back. However, something that is less pleasant to consider is when there is a mistake in your tax return.

Identify What Went Wrong On Your Tax Return

There are unfortunately a number of ways you can have mistakes occur on your tax return. The three most common ways errors happen are:

Personal tax preparation error – Sometimes, the error occurs when you prepare your taxes on your own. These errors may occur due to incorrect math, claiming inaccurate tax credits or deductions, or other easily made mistakes.

Employer mistake – If your employer makes an error in your withholdings, whether the issue is with your state or federal taxes, that can lead to a significant issue with your overall tax return.

Inexperienced tax preparer – There are many different levels of tax preparers ranging from a seasonal preparer to a trained accountant. If you opt for the cheaper and less experienced services of a seasonal tax preparer to file your tax return, the chance for errors is much higher.

By working with AA Tax & Accounting Services, you can have your taxes properly prepared the first time around. Also, you can be reassured by our guarantee that if an issue does arise with taxes that we file for you, our tax resolution service will be provided for free to correct the issue.

Start To Work Toward Resolving Your Tax Mistake

Once the error is known to you, it is critical that you start the process to correct the mistake on your taxes. It is best not to wait to see if the IRS will contact you with a penalty. Instead, it is always best if you start the resolution process before you are pressed to do so.

You may need to do a bit of research to determine if the mistake you have identified is the only one. After you correct one error, your tax returns may receive more attention to be sure that all the mistakes are caught and fixed.

Determine What You Need To Be Filed To Correct The Issue

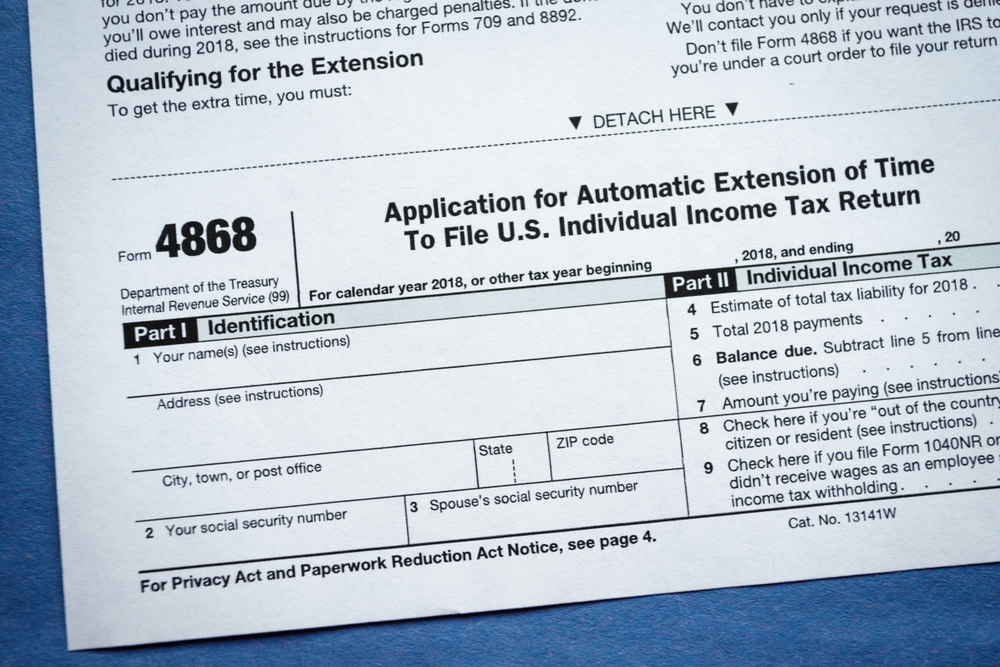

If the IRS reaches out to you concerning a correction on your tax returns, they will help you through the process of correcting the filing error. However, if you find the problem on your own, there are different steps you may need to take.

For instance, if there is an error on your federal taxes, you will need to file Form 1040X, which is the amended U.S. individual income tax return. By filling out this form, you can correct previous federal tax return errors. Should you have more than one year of federal tax return mistakes to correct, you will need to file a Form 1040X for each year.

As for your state taxes, if you are a Utah resident, you will need to file the Utah individual tax return Form TC-40. On line 29, you will indicate that you are filing an amendment, with line 37 detailing what you previously paid. From there, you can correct your state tax return.

Take Your Tax Preparation To Cedar City’s AA Tax & Accounting Services

If you are concerned about making new mistakes and want your tax return filed properly, then AA Tax & Accounting Services is here for you. Our Cedar City accountant has helped countless people prepare and file their taxes, and he can help you overcome your tax hurdles as well.

For help with your tax preparation, contact us to meet with our accountant and start enjoying greater tax protection.