Investments, savings accounts, bills, taxes, interest rates, inflation…these are terms that are enough to give anyone a headache. The time and energy spent on keeping afloat, much less building a portfolio, can be maddening.

Statistics on the matter don’t help things.

The average individual knows nothing about managing their financial accounts. In fact, in 2014 The Atlantic published an article claiming that only 30% of Americans could answer three basic financial questions correctly when asked. The top performing country (Germany) still only scored 53% themselves.

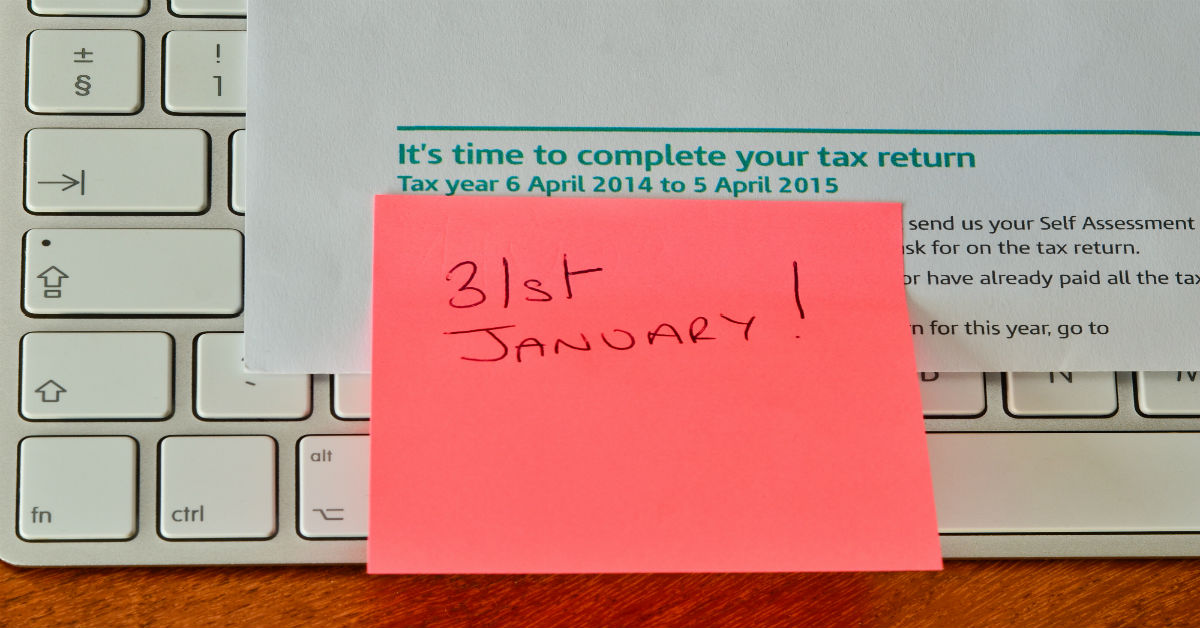

The Risks Of Doing Your Own Bookkeeping

Given those statistics, it isn’t a surprise that so many risks are involved in an individual maintaining their own financial accounts.

You may overlook a pending bill and pay it a week late, leading to your credit rating taking a hit as a result. Or you could have miscounted the amount in your checking when you made a purchase, and ended up with a costly bank fee.

It isn’t all risks to your credit score that you have to worry about. You may just not be getting as much back as you could be, and you would have no way of knowing. Are you making the right investments to give you the maximum return? Would you be better off with a Traditional IRA, or a Roth IRA? Is it worth buying stock, and if so, what stock?

You may be losing money, credit standing, and opportunities by managing your own finances.

Hiring A Professional

You have three options for hiring a professional to maintain your accounts.

First is a Certified Public Accountant (CPA). A CPA has done through extensive training, and holds a college degree in the accounting field. They have been licensed through the American Institute of Certified Public Accountants. This gives them a high level of authority on financial matters, including investing and planning for the future.

Next is an accountant. Someone who has been trained in accounting may or may not have a university degree. Often they will hold at least a certificate showing that they have finished some kind of financial course. While able to give advice on future planning, they are often sought more for tax and billing purposes.

Last is a bookkeeper. The average bookkeeper manages your basic financial needs, such as paying bills on time, monitoring checking accounts, reading and responding to credit card charges, and allocating a percentage monthly to savings accounts. A bookkeeper may or may not hold a certification in a financial discipline.

Hiring a professional will vary in cost based on your city, how much you make, and how much help you need. A simple bookkeeping service may cost as little as $10 per hour, while a full service CPA or accountant could cost up to $50 an hour, or more.

Good Decisions Now For Financial Stability In Your Future

Finding the right balance of professional and individual bookkeeping can have a huge impact on the stability of your future. Whatever you decide, remember that you are building a foundation for your life that may decide on everything from your status as a homeowner, to your retirement age.

Make the right choice for you and your family!