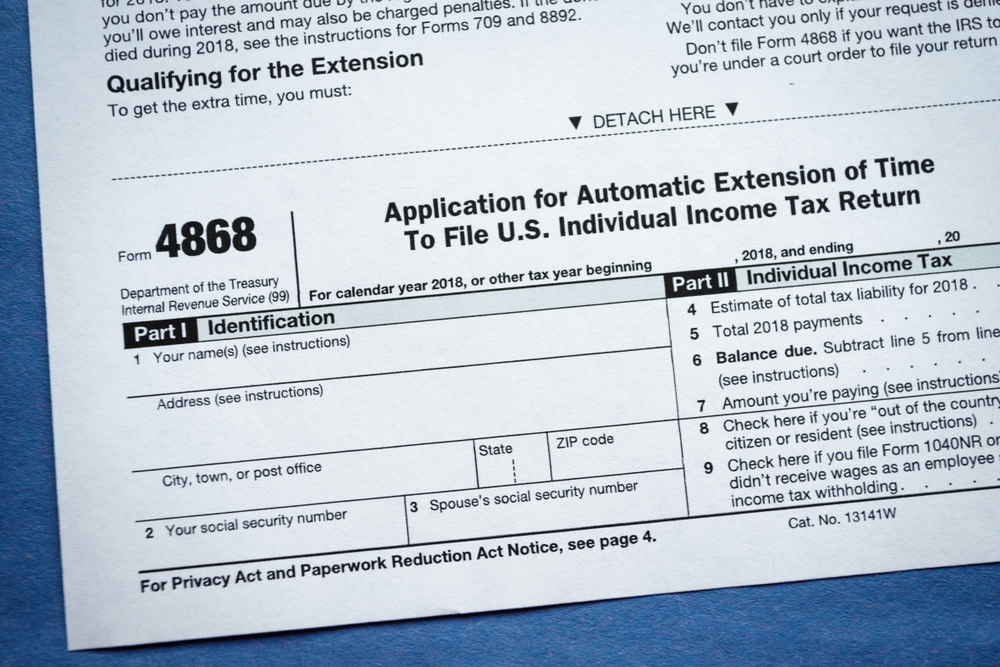

Tax season is in full swing, and our accountant in Cedar City has been seeing plenty of clients who have inquired about tax extensions.

While an extension can be a helpful tool if you are waiting on paperwork or are a small business owner looking to make contributions to their retirement fund, there are several instances where you should avoid filing a tax extension.

Extensions Only Apply To Filling, Not Your Tax Payment

One of the main reasons people initially consider filing a tax extension is because they are unsure or unable to pay the taxes they owe. However, this is not what an extension is not designed for this purpose. An extension of your taxes only allows you to have more time to file your tax return. You will still need to pay any taxes you owe.

This requirement can sound counter-intuitive, as you may not know exactly how much you owe in taxes until you complete your return. But by working with our tax accountant, you should have estimated tax payments that you can use to pay your taxes by the original filing deadline. If it turns out that you have overpaid after you file your extended taxes, you can receive a refund from the IRS.

IRAs Are Not Able To Be Recharacterized

Prior to the passing of the Tax Cuts and Jobs Act (TCJA), you could file an extension and recharacterize your IRA, converting a traditional IRA into a Roth IRA or vice versa, all while you finish filing your tax return. But since the TCJA has passed, your IRA cannot be changed during a tax extension. So, if you were planning on recharacterizing it, be sure it is done by April 15, 2019.

Tax Extensions Do Not Apply For Married Filing Status Amendments

For those married couples who originally filed jointly wish to change their filing status, they only have until April 15, 2019, to file an amended tax return that reflects their decision to file married, filing separately. Our accountant can assist you in amended your tax return to reflect your new filing status, but you will need to come in before the original filing date, as extensions will not apply.

If you would like expert assistance with your taxes, contact us. Our accountant has an office in Cedar City and St. George and is ready to help you with your tax preparation needs as well as your other accounting needs.

Speak Your Mind